In its most simple form, we focus on good businesses that are going well. Through a wide range of financial literature, the ‘Quality Factor’ has been shown to provide outperformance over time with a lower level of volatility. When defining 'Quality', we utilise both Quantitative and Qualitative analysis of businesses.

When analysing data, 'Quality' is generally focussed on profitability. This is commonly measured by Return on Equity (ROE). To identify businesses that are generating expanding profits in a relatively consistent manner over time, an improving trend in ROE is often more important than a high ROE. Metrics to measure cashflow, balance sheet strength and capital intensity of a business will be useful in assessing quality.

Then, where the data ends and our qualitative judgement begins, we want to seek growing businesses operating in a growing markets or sectors. Quality businesses should not appear mature, or saturated within their sector. Good competitive advantages or pricing power demonstrate an ability to maintain strong profitability and withstand competition. Scalability is important to find businesses that become more profitable with increasing revenue. There is limited value in a business getting ‘bigger’ if the profitability declines as a result. Business operations should be relatively stable and consistent over time rather than highly volatile.

Many people will intuitively feel that following a momentum strategy is dangerous and leads to poor results. A momentum approach flies in the face of a Buy Low, Sell High mentality. But a systematic and objective momentum strategy has been demonstrated to capture the Wisdom of Crowds concept to deliver strong returns over time.

Many people will intuitively feel that following a momentum strategy is dangerous and leads to poor results. A momentum approach flies in the face of a Buy Low, Sell High mentality. But a systematic and objective momentum strategy has been demonstrated to capture the Wisdom of Crowds concept to deliver strong returns over time.

Data shows that a momentum-based approach is one of the most successful investment factors over nearly a century.

Investments don’t tend to perform well or poorly in a random fashion. Those performing well tend to be good businesses and those performing poorly tend to be poor or declining businesses.

Of course, there will be turning points and extremes – so a momentum system should be data driven and take a probabilistic approach. Understanding the appropriate momentum triggers is vital to filter the signal from the noise.

We find Value to be one of the most sought after, but most misunderstood investment characteristics.

We find Value to be one of the most sought after, but most misunderstood investment characteristics.

Often espoused as a low risk approach with a ‘margin of safety’, academic literature actually finds value to be a high risk approach that can provide leverage to improving economic conditions. While the market is not perfectly efficient, cheap stocks are typically cheap for a reason. As a ‘risk factor’, value has been shown to provide a return premium in historic data.

It is important to recognise that this has been a highly cyclical approach that has tended to work best in times of rising inflation and economic growth.

Conversely, our studies have found that taking a qualitative approach to valuation (by attempting to identify a fair value using precise forecasts for many years of future data) does not yield any performance benefits.

We find it unrealistic to assume that we (or anyone) can precisely predict the earnings of any business or economic data point, years into the future. Despite the strong inclination to make short term forecasts, we avoid this in our approach as we have been unable to verify any positive performance attribution.

Understanding the value factor in investing and using it in a pragmatic manner rather than a tightly held belief has been vital to our success.

From theory to practise: After pouring over data and agonising over uncertainty, we incorporate an objective approach and strong discipline in providing investment advice to our clients.

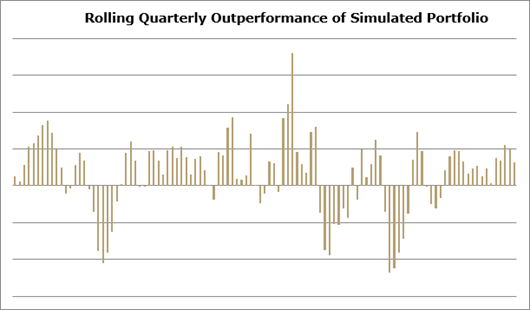

Research on the ability of experts to make forecasts shows several characteristics that lead to greater forecasting skill. Recording results and analysing outcomes forms a vital part of this, and our Simulated Portfolio has performed this role for us. Only by recording and verifying the various aspects of our approach have we been able to analyse and constantly improve our investment systems over time. And the results of this have been very satisfying.

We highlight our periods of underperformance because being honest with ourselves and setting realistic expectations is important to us. But through that, we are very proud to be able to demonstrate strong investment success for our clients through the advice that we provide.